Online agents’ market share fell in 2024 to 5.2% which is 7% lower than 2023 and 32% lower than 2019.

This group also lost share in all price brackets below £1m, with the largest decline seen in the lower priced band of £0-£200k (-13% in the last year).

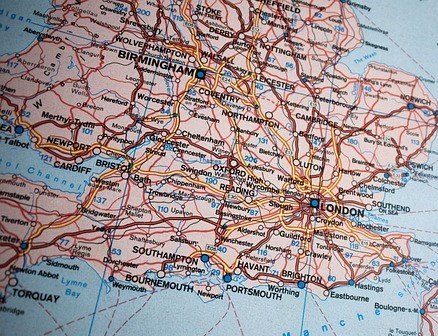

They also saw a fall across all regions of the UK with the exception of the South West, with the North and Midlands experiencing the largest reductions.

Meanwhile, self-employed agents continued to rapidly grow with their market share rising to 1.8%. This is 31% higher than 2023 and 592% higher than 2019. As a collective, they now have a larger market share than Purplebricks (1.6%), and William H Brown (1.4%)

Katy Billany, executive director of TwentyEA, which provided the data, said: “As the market continues to evolve with the numbers of self-employed agencies now higher than ever, there’s no better time to understand the competitive landscape through the power of data.

“Tracking market activity in real-time gives agents the chance to discover how they, their competitors and the national market are performing. These are necessary foundation blocks for agents to launch an effective business strategy which can identify opportunities while helping them to laser-focus their marketing on the right audience.”

Daily news email from EYE

Enter your email below to receive the latest news each morning direct to your inbox.