This week, I am joined on the UK Property Market Stats Show by the awesome Alice Bullard, CEO of Nested, to delve into the key property market headlines for Week 3 of 2025 – ending Sunday 26th January 2025.

Listings (new properties on the market)

34.9k new listings this week (last week 33.7k)

That’s 17% higher than Week 3 of 2024 YTD and 14% higher YTD compared to 2017/18/19.

Price Reductions (% of resi stock)

19.9k Price Reductions this week – meaning approx. 14.8% of resi sales stock this month has been reduced.

To compare, 7.8% of residential sales stock reduced in December (always a lower % in Dec).

For comparison, 11.1% of stoics reduced in November and 11.9% average in 2024, though the long-term 5-year average is 10.6%. December traditionally sees a dip in this metric.

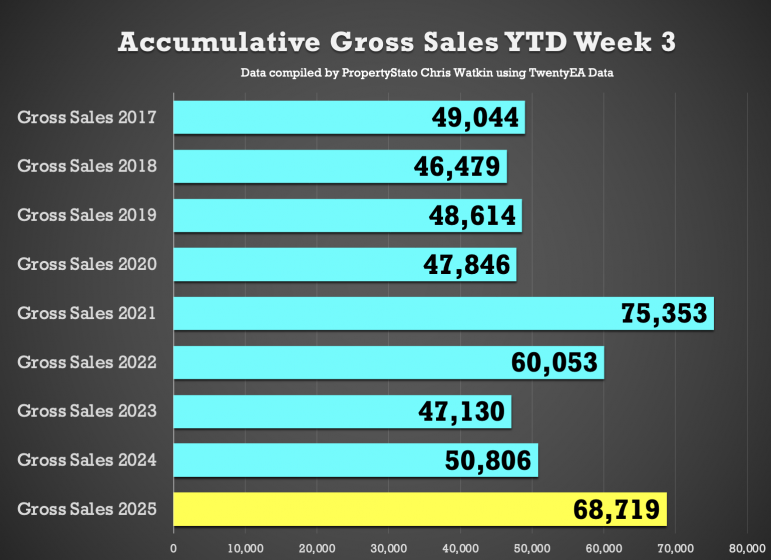

Total Gross Sales (agreed sales)

25.7k UK homes sold STC this week, up from 23.8k last week in Week 2

That’s 35% higher YTD compared to 2024 and 43% higher than 2017/18/19 YTD levels.

Sale-Through Rate (monthly in arrears)

Approx. Run rate of 14.2% of resi stock sold stc in Jan. For comparison, 10.61% of residential sales stock sold in December 2024, compared to 8.79% in December 2023. 2024 monthly average: 15.3%. Long-term 7-year average: 17.9%. Graph 12

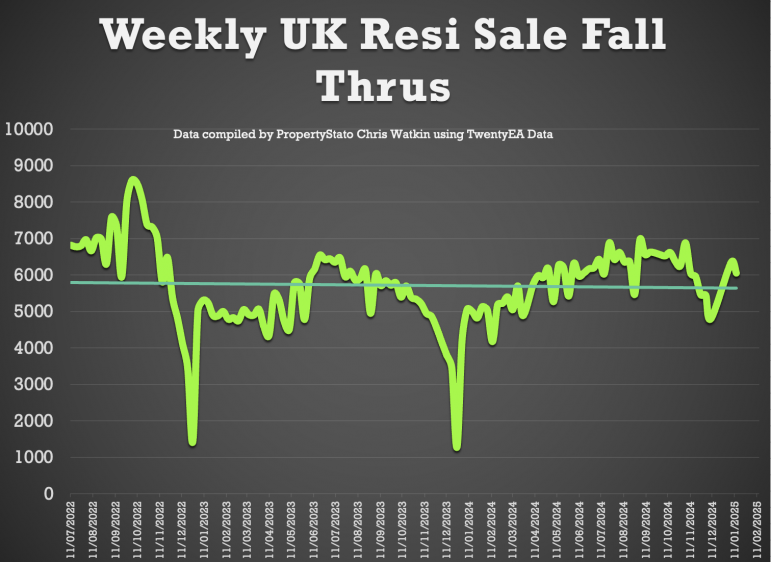

Sale Fall-Throughs

23.3% of gross sales fell through this week – ad top from last week at 25.4%. Slightly below the 7-year average of 24.2%, but well below the 40%+ levels post-Truss Budget (Autumn 2022).

On a monthly basis, approximately 5.4% of sales in the UK agents pipelines have fallen thru in Jan 25. For comparison, 3.8% of the December 2024 sales pipeline fell through (Dec is always lower) (2024 average: 5.36%).

Net Sales (Gross sales for the week less sale fall throughs for the week)

19.7k net sales this week, compared to a typical week 3 average of 18.1k. Last week (Week 2 2025) – 17.7k.

2025 YTD is 38% higher than compared to 2024 YTD and 39.7% higher than YTD 2017/18/19.

Residential sales stock on the market

605k properties on the market at the end of December 2024 (down from 677k in November).

Historical comparison for end of December:

+ 2023: 560k

+ 2022: 481k

+ 2021: 342k

+ 2020: 543k

+ 2019: 545k.

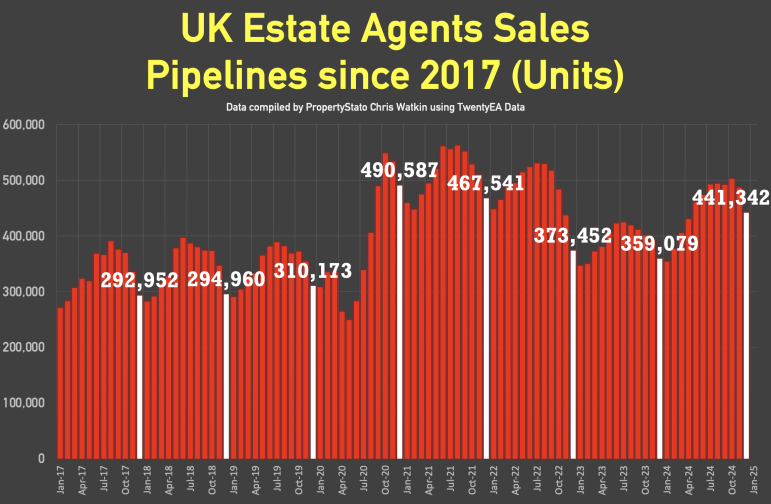

Residential Sales Sold STC Pipeline

441k sales agreed but not yet completed at the end of December 2024.

Historical comparison for December :

+ 2023: 359k

+ 2022: 373k

+ 2021: 468k

+ 2020: 548k

+ 2019: 310k.

UK House Prices (£/sq.ft)

As always, the £/sq.ft metric predicts Land Registry figures five months in advance with 92% accuracy (the orange line of the graph).

December’s final figure: £339/sq.ft.

+ November: £342/sq.ft

+ August: £334/sq.ft

+ December 2023: £322/sq.ft.

This means house prices have risen 5.28% in the last 12 months.

Local Focus – Wembley

Do not miss our deep dive into the property market in Wembley this week, where we uncover the stats and trends shaping this local market.

Why Should you Watch the Show?

Estate Agents, this show is designed for you.

From understanding the big picture market trends to translating them into actionable insights for your business, the Stat Show is your weekly must-watch.

Remember, in the survey of 10,000 homeowners last year with the Property Academy, 36% of homeowners chose their estate agent based on the estate agent’s property market knowledge. This show and graphs will help you