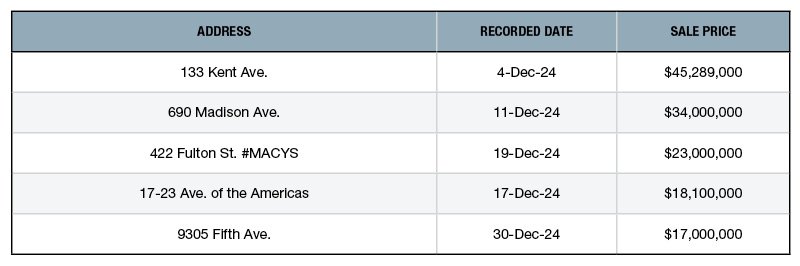

Sale Price: $45.3 million

Joyland Group, in joint venture with Prospect Development, has acquired the 5,000-square-foot retail building in Williamsburg from L3 Capital. The buyer secured $85 million in construction financing through a collateral mortgage provided by S3 Capital.

The partnership plans to continue and complete the conversion project at the property, that will result in a six-story mixed-use building with 43 condominium units and 17,500 square feet of retail space, according to CityBiz. The same source reveals that JLL represented the seller, procured the buyer and arranged the financing. The one-story building at 133 Kent Ave. was completed in 1950 and has 60,000 square feet of unused air rights.

Sale Price: $34 million

Wharton Properties picked up the 6,620-square-foot retail property in Manhattan’s Lenox Hill from SL Green. According to The Real Deal, the buyer bought a 50 percent ownership stake from SL Green. The same source shows that Eastdil Secured represented the seller.

The five-story property includes 1,324 square feet of office space and 7,674 square feet of unused air rights. In a recent deal, Van Cleef & Arpels luxury jewelry brand signed a leasing agreement for all five floors, according to the company’s website.

Sale Price: $23 million

Macy’s has sold the 438,498-square-foot retail portion of a 14-story building in downtown Brooklyn to three entities. The buyers include a group of investors led by United American Land, Crown Acquisitions and The Jackson Group. Totaling 844,378 square feet, the building dates back to 1920 and was used as a Macy’s department store that first opened in 1995.

Macy’s sold the property’s upper floors to Tishman Speyer in 2015, where the company constructed 622,000 square feet of office space, in a portion of the building dubbed The Wheeler. The remaining four floors that sold are part of Macy’s strategy to close up to 150 stores in the U.S., in a period of three years. In 2025, the company will close up to 66 locations, in an effort to turn a profit and invest in its remaining locations and brands.

Sale Price: $18.1 million

Local development company Sumaida + Khurana purchased the 11,700-square-foot retail building in the borough’s TriBeCa neighborhood from affiliates of the Matera family. Cerco Funding provided $15.3 million in acquisition financing for the buyer.

The three-story building includes 4,450 square feet of office space, as well as 2,800 square feet of residential space. The property was home to Tribeca Pharmacy, that vacated the building earlier last year, according to New York Business Journal.

Sale Price: $17 million

Staples Inc. has sold the 12,880-square-foot retail property in the Bay Ridge neighborhood to a private buyer. The new ownership secured a $10 million loan from Castellan Capital. The one-story property dates back to 1958 and served as one of Staples Inc.’s stores. It includes 65,130 square feet of additional air rights and is close to multiple bus stops, as well as to the Bay Ridge subway station on 95th Street.

—Posted on January 28, 2025