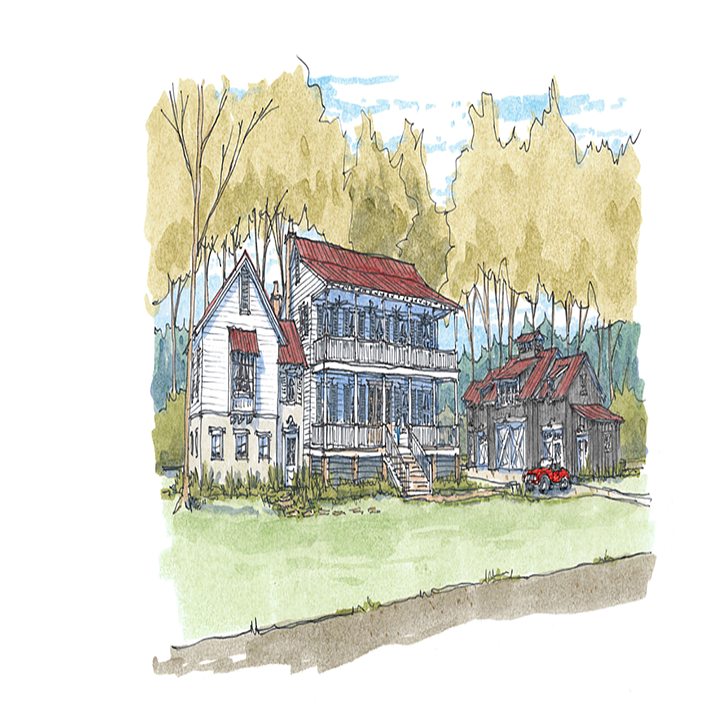

Nothing in life is free. Not that which comes easily or that which we work for. The cost may be intangible but has a measurable effect on time, finances, effort, friendships, at oftentimes even family relationships. In the grand scheme of our lives, and resisting a slant to the cynical, everything has a cost, though some being more overt than others. If we were to meet randomly and I said that you could own a home in a romantic lowcountry setting, just down the road from Charleston, that lets your family step aside from the hubbub of your life, and that this home could be yours at no-to-minimal cost to yourself, appreciate as the years roll by, and bring a little cash flow along the way would you think me deluded, mad, conspiratorial? We are doing just that in Palmetto Bluff and here is the story of how.

Nothing in life is free. Not that which comes easily or that which we work for. The cost may be intangible but has a measurable effect on time, finances, effort, friendships, at oftentimes even family relationships. In the grand scheme of our lives, and resisting a slant to the cynical, everything has a cost, though some being more overt than others. If we were to meet randomly and I said that you could own a home in a romantic lowcountry setting, just down the road from Charleston, that lets your family step aside from the hubbub of your life, and that this home could be yours at no-to-minimal cost to yourself, appreciate as the years roll by, and bring a little cash flow along the way would you think me deluded, mad, conspiratorial? We are doing just that in Palmetto Bluff and here is the story of how.

So we now have a model, based on existing rental histories in the area, plus bank finance, our best estimate of build costs and our cautious assumptions as outlined above. The key to this scenario is seeing this home in Palmetto Bluff as an investment asset, and managing it that way. As investors who have done our due diligence and outlined a fairly achievable formula for success of a portfolio asset, here is the outcome that we can comfortably expect:

Asset Management Formula for STR in Palmetto Bluff:

– A $400K land price and $1.1M build cost.

– A 50% rental occupation leaving 6 months of the year for us to use the property ourselves – less than 2 hours from the home we keep in Charleston SC.

– At 60% Loan-to-Cost, the project pays all the operating costs, fees, insurances, and utilities. It pays for the finance including interest and principal, services and anticipated maintenance.

– Above that, it returns about $100K in positive cash flow after all related costs are accounted for.

– the cost of owning this home is zero, and we get to enjoy its use for 6 months of the year at virtually no cost to us.

– the return on the cash we have invested is 16% ($100K on $600K cash)

– The equity gain each year on money committed is 10% ($63K being 2% on finance and 3% inflation).

When making the evaluation on adding assets to our portfolio, seeing the returns that can be made on an asset that is eligible for legal short-term rental, is a formula we know and understand well. And while our vacation rental company here in Charleston successfully manages a growing portfolio of luxury vacation rentals both downtown and on Folly Beach, Bluffton SC is a growing tourist destination and a sensible marketplace to expand our Luxury Simplified Retreats brand.